Building wealth can be easy. Learn everything about mutual funds.

Mutual Funds

Advantages

The first advantage is mutual funds allow diversification even with a small capital. For example, if you want to invest Rs2000 to Rs 4000, you can’t buy many shares. But because MFs pool many people’s money together, it is possible that you can invest in as many shares as you want.

- The second advantage is that it is an expert who is managing your money. If you go by yourself to an expert and want investment advice, the expert’s fees might be more than the amount that you want to invest. On the other hand, when you go through mutual funds, all the investors are collectively paying for the expert and at a cheaper rate. The fee charged by the fund manager is called the Expense Ratio. For example, if you want to invest Rs 100 and you give it to the fund. The fund will invest 98 or 99 rupees and the remaining will be the expense ratio. It obviously depends on the fund, but lower the expense ratio, the better it is for you

2. The third advantage is that you only have to invest in the funds once and your work is done. After that all the regular transactions of buying and selling are done by the fund on your behalf.

3. The fourth advantage is that of the SIP.

SIP stands for Systematic Investment Plan and it means that you can make a mandate at your bank so that every month Rs 2000, Rs 5000 or whatever amount you decide will get invested automatically and you don’t have to worry about it. You can stop this SIP, increase the amount or decrease it whenever you want. It’s flexible and doesn’t require you to pay a charge.

Types of Mutual Funds

You may have heard about the debate between which funds are good – Active or Index. Active funds are good.

Index funds are good. People keep shuffling but nobody probably gave you the right information. Someone might have told you that active funds are good when that is not the case. And what is that thing about Index funds that I

don’t like.

By the end of this article, you will be able to decide for yourself as to which funds are good for you.

The discussion on Index funds was very popular in the last one or two years. This happened because Warren Buffet had said that passive funds are a good investment option. Even in India the infl ow was growing rapidly and is it

good or bad? Giving a blank statement like that would be bad practice but we have to understand Index funds in the context of India. Because when Warren Buffet said that Index funds were a good investment, it’s first reason was that in the American and European countries, the stock market is efficient and most of the people invest in it.

Which is why undervalued stocks aren’t easily available there and this makes it very difficult for even fund managers to beat them. And hence, rather than taking so many efforts, it’s better to invest in index funds and keep getting returns as given by companies in sensex and nifty in India. Index funds are the funds that invest in a broader market like Sensex or Nifty

How to invest in mutual funds

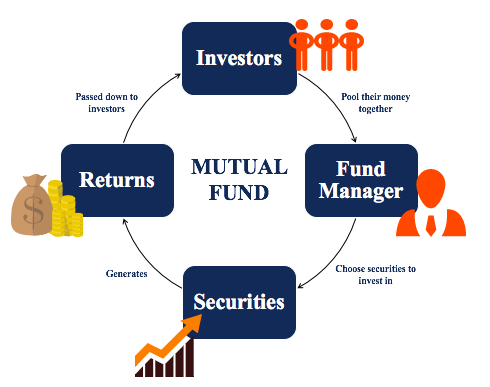

Regardless of whether you’ve come across this guide before, it’d be safe to assume that you would have heard of mutual funds before. But what exactly are they? A mutual fund is a collection of bonds, stocks and other securities that are professionally managed by expert managers or asset management companies (AMC). After deductions, the resulting profit is given back to the investors in the form of capital appreciation or dividends. To put it simply, you can safely invest your money, knowing that an expert will be watching over it. The result? Great returns without you having to be too involved

Buying a Share in a Mutual Fund

When you buy a part in a mutual fund, its equivalent to having a stake in a small part of all the investments in the fund. It is a simple way to make a diversified investment. It is quite useful for an individual investor who doesn’t have the time to analyze multiple individual stocks in the market, or soak up knowledge on them, or for those just looking for diversifying their investments. In fact, purchasing a single investment will be like buying an entire portfolio of stocks.

Manage your portfolio

Once you choose a path, you will need to create an account with a brokerage house providing MF distribution services, and complete you KYC, or “Know Your Customer”. Next, it is essential to create a Mutual Fund portfolio, which will involve short listing schemes which have a history of good performances. Your portfolio

should have a good balance of both low risk and high risk elements. It is important to keep in mind your risk profile, as well as your investment objectives in mind. Compare different mutual fund investment schemes, on the basis of their policies and past performances. Refer to the prospectus provided by the AMC, which will provide information related to the fund from a legal perspective, and help you gauge the consistency of returns on your investment.

You should also know that while some mutual funds are open-ended, others are close-ended. The former refers to a type of fund in which you can withdraw your investment at any point of time, while the latter refers to one which prohibits you from doing so. Close-ended funds have fixed maturities, and money can be withdrawn only when maturity is reached. Investments should hence be done accordingly. It is important to know, though, that even after making the investment, it is essential to keep a track, i.e. monitor your funds.

Mutual funds have a lot of benefits, the most important being diversification of investments. Investing in these funds helps establish a balanced portfolio, by including assets that are not directly related. Such assets may include a mixture of equity, debt, money market and sector specific funds. This will minimize risks and maximize profits.